SERVICES & PROCESS

Vita Wealth Management offers comprehensive financial services, including investment management, retirement planning, tax strategies, and personalized wealth management to help clients achieve their financial goals.

Expert Guidance. Personalized Strategies. Financial Confidence.

At Vita Wealth Management, we offer a comprehensive range of services designed to address every aspect of your financial life, from tax planning and retirement planning to estate planning and investment management. With years of experience and a commitment to personalized service, we work closely with each client to create customized strategies that align with their unique goals. Whether it's education planning, debt strategy, or tax-efficient investing, our expertise ensures that every decision is made with your long-term financial success in mind. We also provide specialized services such as company benefit planning, equity compensation, and asset protection to help you maximize the resources available to you. Serving clients nationwide, we are dedicated to delivering objective, hands-on financial advice to individuals, families, and businesses, no matter where you’re located.

Investment Management

Tax Planning

Retirement Planning

Tax Preparation

Tax Efficient Investing

Company Benefit Planning

Estate Planning

Equity Compensation

Insurance Planning

Real Estate Analysis

Asset Protection

Gifting Strategies

Debt Strategy

Cash Flow Strategy

Life & Education Planning

Debt Strategy

Cash Flow Strategy

Life & Education Planning

Client Onboarding

Mutual Fit Meeting

01

Determine if we mutually agree it makes sense to work together. The goal of this meeting is to get to know you, your situation, and what you're looking for in a financial planning relationship.

02

Financial Dashboard — Onboard in Right Capital

Enter financial data into RightCapital to begin the planning process.

03

MEETING #1:

“Get Organized” Meeting

Review financial data, fill in gaps, and discuss goals and values.

04

MEETING #2:

Vision & Observations

Explore possibilities and priorities for financial future.

05

MEETING #3:

Plan Review & Implementation Phase

Review the financial plan and set up implementation steps.

06

Implementation of Financial Plan

Implement the action items outlined in the financial plan.

Annual Service Calendar

Meeting 1

January - May

- New Tax Projections for Next Year

- Tax Preparation & Filing

- Net Worth & Income Update

- Cash Flow & Spending Projections

Meeting 2

September - November

- Employee Benefits Review

- Insurance Review (Even Years)

- Estate Review (Odd Years)

- Cash Flow Review

Meeting 3

December

- Tax Projections for Current Year

- End of Year Tax Planning

- Year End Giving

- Outstanding Task List

- Required Minimum Distributions

- Investment Plan

Ongoing Support

- Investment Monitoring & Rebalancing

- On-Demand Meetings as Questions Arise

- Unlimited Email & Virtual Support

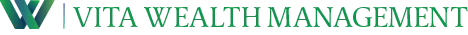

The True Value of Financial Advice

At Vita Wealth Management, we believe that financial planning goes beyond just managing numbers – it’s about helping you live the life you envision. Studies by Morningstar, Envestnet, Vanguard, and Russell estimate the value of a financial planning relationship to be an extra 3-5% return on an annual basis when incorporating all of the different areas of wealth. The tangible value of our financial advice lies in our ability to create tailored, tax-efficient strategies that help you grow, protect, and manage your wealth. Through meticulous planning, we empower you to make informed decisions about investments, retirement, and taxes, providing you with clear steps to reach your financial goals. Equally important is the intangible value: the peace of mind and confidence that comes with knowing you have a dedicated, objective partner guiding you through life’s financial decisions. Our personalized approach ensures that your plan evolves with your life, giving you the freedom to focus on what matters most.